The Philippine online casino market is experiencing unprecedented expansion in 2025, transforming the country into one of Asia’s most dynamic digital gambling hubs. This remarkable growth trajectory is reshaping the entertainment landscape for Filipino players while creating significant economic opportunities throughout the nation. Let’s examine the key factors driving this expansion and what it means for stakeholders across the industry.

Record-Breaking Market Expansion

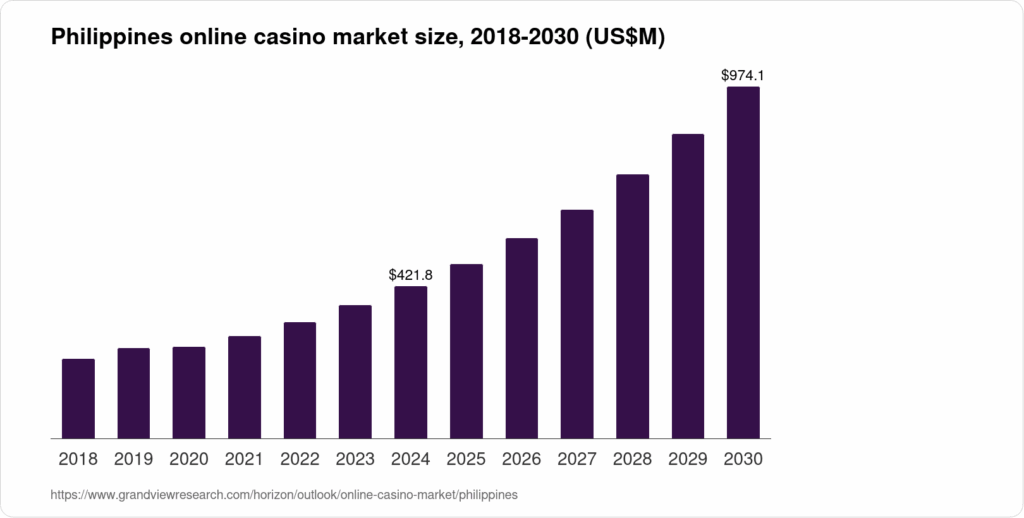

The numbers tell a compelling story of explosive growth in the Philippine online casino sector. According to recent industry trends data, the market has expanded by an impressive 37% in the first half of 2025 alone, continuing the upward momentum that began during the pandemic years.

“We’re witnessing growth rates that exceed even our most optimistic projections from 2023,” explains Maria Santos, digital gaming analyst at Manila-based Altura Consulting. “The Philippine online casino market is now valued at approximately ₱87 billion (US$1.5 billion), and we expect it to reach ₱115 billion by year’s end.”

This growth significantly outpaces traditional land-based casino expansion, which has settled into a more modest 8-10% annual growth rate. Online operators now account for nearly 40% of total gambling revenue in the Philippines, up from just 22% in 2023.

Key Growth Drivers

Several interconnected factors are fueling this remarkable market expansion:

1. Mobile Technology Penetration

Smartphone ownership in the Philippines has reached an all-time high of 92% among adults under 45, with affordable data plans making continuous connectivity accessible to most Filipinos. The average mobile internet speed has doubled since 2023, now exceeding 45 Mbps in metropolitan areas.

“The technological barriers that once limited online casino growth have largely disappeared,” notes technology analyst Rafael Mendoza. “Today’s entry-level smartphones can easily handle sophisticated casino applications and HD streaming for live dealer games.”

This mobile-first approach has been embraced by operators like PlayColorGame, who report that over 85% of their Filipino customers now access services via smartphones rather than desktop computers.

2. Payment Ecosystem Maturation

The digital payment infrastructure in the Philippines has undergone a remarkable transformation, with e-wallet adoption reaching 76% of adults. Services like GCash, Maya, and PayMaya have become household names, processing over ₱2.5 trillion (US$43 billion) in transactions annually.

This payment ecosystem expansion has significantly reduced friction in online gambling transactions. Most platforms now offer instant deposits and withdrawals through multiple digital channels, removing what was previously a major barrier to market growth.

3. Regulatory Clarity

The Philippine Amusement and Gaming Corporation (PAGCOR) has implemented clearer regulatory frameworks for online operators, creating a more stable business environment. The introduction of the “Digital Gaming License” category in late 2024 established transparent rules specifically tailored to online operations.

“The regulatory environment has evolved from being a hindrance to a facilitator of growth,” explains gaming attorney Manuel Roxas. “Operators now have clear guidelines on compliance requirements, allowing them to focus on product development and market expansion rather than navigating ambiguous regulations.”

4. Content Localization

International operators have recognized the importance of culturally relevant content for Filipino players. Games featuring local themes, Tagalog language options, and references to Filipino culture have proven particularly successful.

“The days of simply translating European casino interfaces into English are over,” says gaming developer Isabella Cruz. “Today’s successful platforms offer games designed specifically for Filipino players, incorporating cultural references that resonate with local audiences.”

Popular titles like “Fiesta Flores” and “Pearl of Manila” have demonstrated the commercial potential of Philippines-focused gaming content, consistently ranking among the most-played slots on multiple platforms.

The Growing Player Base

The demographic profile of Philippine online casino players has broadened significantly in 2025. While previously dominated by males aged 25-40, the market now sees growing participation from:

- Women (now comprising 41% of players, up from 28% in 2023)

- Adults over 50 (the fastest-growing demographic segment)

- Urban professionals utilizing improved mobile connectivity

- Rural players benefiting from expanded internet infrastructure

“The stereotypical image of the young male gambler no longer reflects reality,” explains sociologist Dr. Antonio Reyes. “Online casinos have become mainstream entertainment across diverse segments of Philippine society.”

This broadening player base has contributed to increased acceptance of online gambling as a legitimate entertainment option rather than a fringe activity. Casino comparisons sites report record traffic as consumers research their options in this expanding market.

Emerging Market Trends

Several distinct trends have emerged in the 2025 Philippine online casino landscape:

Live Dealer Dominance

Live dealer games have experienced extraordinary growth, accounting for 47% of total online casino revenue in 2025. The authenticity of human dealers combined with the convenience of online play has proven particularly appealing to Filipino players.

“Live dealer games bridge the gap between traditional casino experiences and digital convenience,” explains casino operations consultant Jaime Tan. “The social element of interacting with real dealers satisfies the Filipino cultural preference for interpersonal connection during entertainment activities.”

Leading platforms now offer multiple live dealer studios with Filipino dealers, customized environments, and gameplay paced to local preferences.

Esports Betting Integration

The convergence of esports and casino gaming represents one of the most innovative developments in the Philippine market. Major platforms now offer seamless movement between traditional casino games and esports betting, capitalizing on the country’s passionate gaming community.

Popular esports titles like Mobile Legends, DOTA 2, and League of Legends now feature alongside slots and table games on unified platforms, creating cross-promotional opportunities that expand the total addressable market.

Cryptocurrency Adoption

Cryptocurrency use for online casino transactions has grown substantially, with approximately 23% of Filipino players having used digital currencies for gambling in 2025. The anonymity, transaction speed, and reduced fees make crypto particularly attractive in this market.

“Cryptocurrency adoption has expanded beyond tech-savvy early adopters to reach mainstream players,” notes fintech analyst Rosa Diaz. “Platforms that offer simplified crypto onboarding experiences have seen significant user growth.”

Challenges and Growing Pains

Despite the impressive growth trajectory, the Philippine online casino market faces several significant challenges:

Responsible Gambling Concerns

The rapid expansion has raised concerns about problem gambling behaviors. Government agencies and industry groups have responded with enhanced responsible gambling initiatives, but critics argue these measures haven’t kept pace with market growth.

“The industry needs to invest in more sophisticated player protection systems,” urges Dr. Maria Lim, addiction specialist at Manila Medical Center. “Algorithms that identify problematic patterns and intervention protocols should be standard across all platforms.”

Market Saturation Concerns

With over 120 online casino brands now targeting Filipino players, some analysts warn of potential market saturation. Consolidation appears increasingly likely as smaller operators struggle to compete with established platforms that benefit from economies of scale.

Infrastructure Limitations

While urban areas enjoy excellent connectivity, approximately 22% of the Philippine population still lacks reliable internet access. This digital divide limits the total addressable market and creates geographical disparities in online gambling participation.

The Economic Impact

The industry’s growth has generated significant economic benefits throughout the Philippines:

- Direct employment of approximately 35,000 Filipinos in online casino operations

- Substantial tax revenue contributing to government programs

- Technology sector growth as support services expand

- Investment in telecommunications infrastructure

“The online casino sector has become a meaningful contributor to the Philippine digital economy,” notes economist Dr. Carlos Santos. “Beyond direct revenue, it stimulates growth in adjacent industries like digital payment systems, customer service, and software development.”

Future Outlook

Industry experts predict continued strong growth through 2026, though likely at a more moderate pace than the current explosive expansion. Key developments to watch include:

- Increased regulatory scrutiny as the market matures

- Further consolidation among operators

- Enhanced integration of augmented and virtual reality technologies

- Growing emphasis on responsible gambling protocols

“The Philippine online casino market has reached a critical mass that ensures its continued importance in the entertainment landscape,” concludes analyst Maria Santos. “The challenge now shifts from growth to sustainability and responsible management of this maturing industry.”

For Filipino players, this evolution means increasingly sophisticated gaming options, stronger consumer protections, and a gambling ecosystem that continues to innovate at a remarkable pace.